How Enrollment Works

Members who joined IATSE Local 891 after 2004 are mandatorily enrolled in the Canadian Entertainment Industry Retirement Plan (CEIRP) and the employer paid RSP contributions are automatically credited to their CEIRP RRSP accounts. Members can also choose to top up the employer contributions with additional voluntary contributions.

Members who joined IATSE Local 891 before 2004 may enroll with CEIRP voluntarily to start receiving plan benefits. Members who are not sure if they are enrolled, please see the "Pension Line" information below.

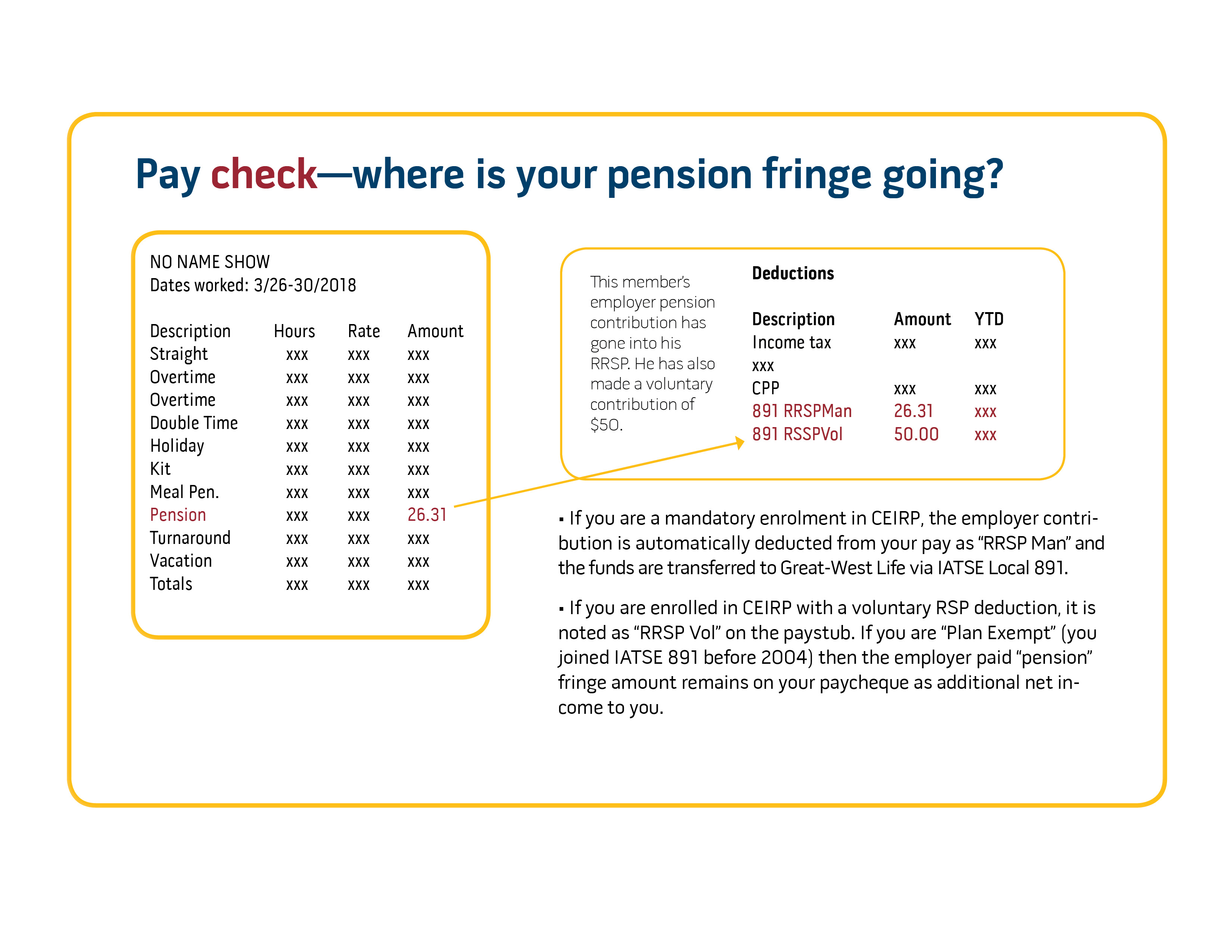

The "Pension" Line on Each Paycheque

- With every paycheque earned under an IATSE Local 891 collective agreement, the employer contributes a percentage of fringe earnings towards the employee's retirement. This 'Pension' fringe is usually noted on the left 'Income' side of the paystub.

- If mandatorily enrolled in CEIRP, the employer contribution is automatically deducted from a members' pay and is shown on the right side of the paystub as 'RRSP Man.' Deducted funds are transferred to Great-West Life.

- If enrolled voluntarily in CEIRP, the deduction is noted as 'RRSP Vol' on the right side of the paystub.

- If a member is not enrolled in the Plan at all, then there is no deduction and the employer paid 'pension' fringe amount remains on the paycheque as additional income.

Click on the image below for a larger view.

How to Enroll

Members who wish to voluntarily enroll in the Plan, or, if already enrolled and now wish to make voluntary contributions, should contact us and ask to speak to our RRSP Group Plan Administrator.

In order to save for retirement, members who are not currently contributing to an RSP with CEIRP should have another financial retirement plan in place.